Preparing for tax filing in the first quarter presents a significant challenge for many individuals and families, especially those with complex financial arrangements. Establishing the right systems and partnerships in advance enables you to navigate the Q1 tax season smoothly. A methodical approach can prevent typical stress points such as last-minute document hunts, errors in asset tallying and delays caused by missed coordination deadlines.

Organising Documentation for CPAs and Legal Partners

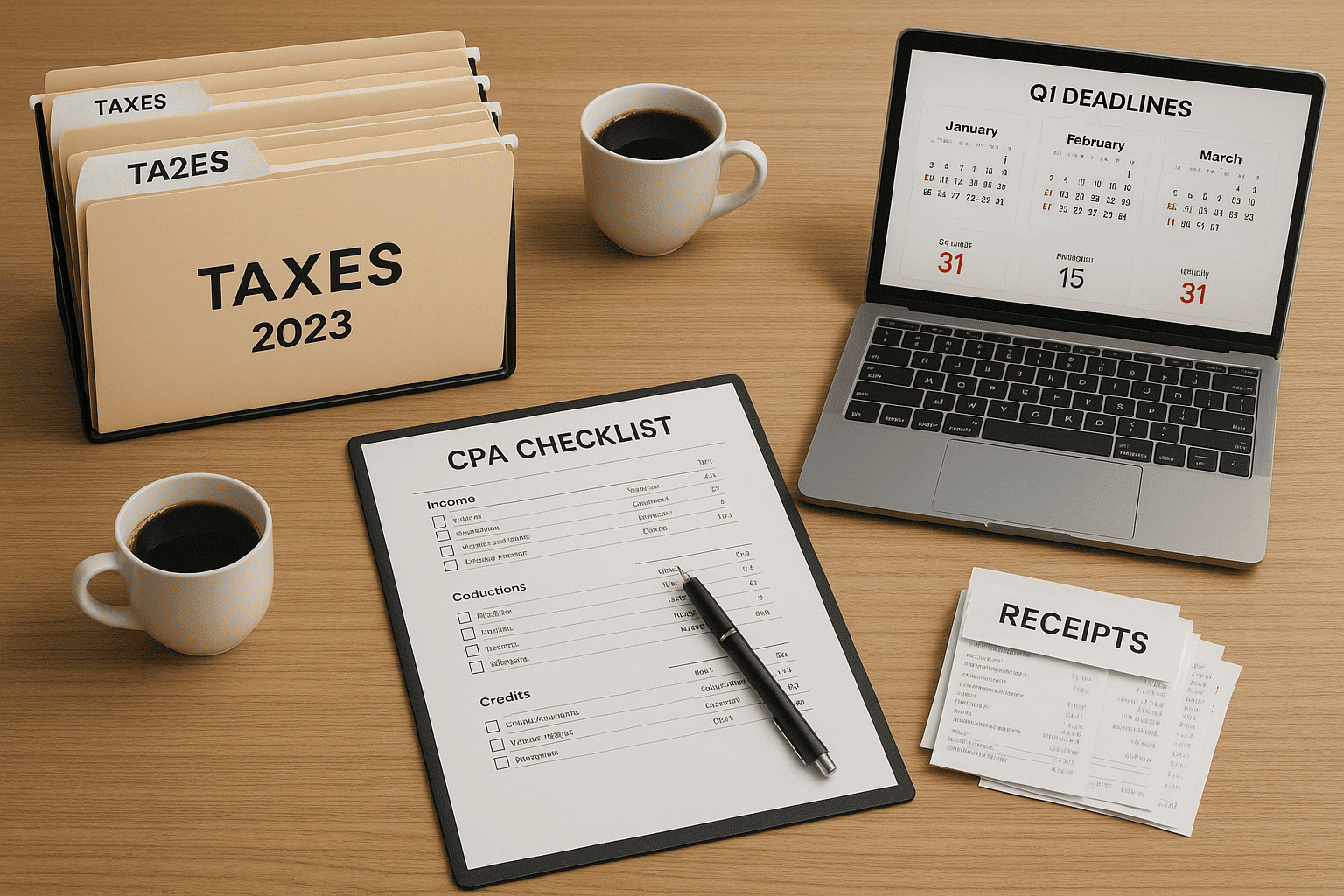

One of the core elements of hassle-free tax prep support is having all relevant paperwork ready. Most accountants and tax advisers require a comprehensive set of documents, so starting early minimises any risk of oversight. Gather items such as bank statements, investment summaries and prior Q4 reporting data. Trust documents, estate records and gift documentation should be at hand if relevant.

Family office admin teams excel at coordinating document collection across multiple accounts and entities. Their oversight extends to managing all personal accounts alongside trusts, estates and business structures. Where professional accounting services are engaged, direct communication lines between the family office admin and CPA ensure nothing is missed.

This early groundwork avoids the chaos of missing receipts or last-minute scanning sessions. If a legal question arises, documentation is already accessible to your tax and legal advisors rather than being tracked down in a time crunch.

Efficient Q4 Reporting: Supporting Tax Filing Logistics

Asset Summaries and Portfolio Statements

Every Q1 tax season relies on Q4 reporting as its foundation. An accurate year-end review of assets underpins the entire process. This includes not only personal bank accounts but also company holdings, stock options and private investments.

For families utilising a family office structure, Q4 reporting integrates all asset categories, listing real estate, trusts, estates and significant purchases. This enables effective tax strategy execution, as decisions regarding deductions or capital gains hinge on this end-of-year snapshot.

Trusts and Donations

Documenting charitable contributions in Q4 can make a substantial difference. Coordinated by family office admin, donation records for both individuals and trusts feed directly into the tax filing calculus. Trustees and estate managers must capture not only what was given, but also corresponding receipts and acknowledgements. This approach supports compliance and maximises qualifying claims. CPA coordination, directly facilitated by admin or accounting services, ensures these items are allocated to the correct schedules.

Minimising Delays: Avoiding Common Pitfalls in Tax Filing Logistics

Reducing the Risk of Late Submissions

The most frequent delay in tax season stems from waiting for missing information. Ensuring all year-end documents are collected early and cross-checked helps avoid this. A proactive family office or personal CFO can set internal deadlines for document delivery. Household management professionals may also help gather information regarding staff payroll, property expenses and related records, helping consolidate reporting obligations well before tax day.

Streamlined Communication

Efficient channels between your financial admin, CPA providers and other advisors lead to fewer miscommunications and prevent duplication. Direct lines help realign priorities in real-time, especially if questions around business structuring or large transactions occur late in Q4. These cheques dramatically lessen the risk of errors and improve the speed of tax prep support as well as final filing.

CPA Coordination and Multi-Advisor Approach

Ensuring Cohesive Q1 Preparation

Coordination with tax attorneys, CPAs and investment advisors is not just helpful, it is vital for complex filings. For those who rely on a family office admin or personal CFO, these teams function as the central coordinator. Business structuring questions, amendments to trusts and strategic changes in estate planning all pass through one point of contact. This centralisation reduces the chances of conflicting recommendations and aligns all professional voices for a unified Q1 approach.

Frequent meetings between your advisory professionals—organised by your finance admin—ensure nothing slips through the cracks. They also help ensure that any late-breaking transactions after Q4 reporting are quickly captured. As your contacts iterate on tax strategy execution, a unified front maintains clarity and accuracy.

Strategic Asset Review and Tax Strategy Execution

Continuous Monitoring and Reporting

Beginning before Q1, all major financial events of the previous year should be captured. This is about more than compliance—it is an opportunity for tax strategy execution that saves money and limits audit risk. Q4 reporting wraps up key summaries just in time for optimisation.

At this stage, families and high-performing individuals should review their allocations. Trusts and estates need documentation updates, and all related business structuring should reflect current needs. The family office admin can prompt for asset reviews that prompt changes before the filing window closes.

Adaptability and Scenario Planning

Changes in income, dividends or distributions may trigger different filing requirements. A coordinated approach between personal CFO, household management professionals and outside advisors keeps everyone alert. Adjusting quarterly payment arrangements or shifting assets to trusts can all fall under this agile admin, led by the right finance professionals and executed in concert with external specialists.

Family Office Admin Excellence: Managing Complexity

Consolidation Across Service Areas

Family office admin serves clients by organising all aspects of tax prep support. They combine accounting services with oversight of trusts and estates, ensuring seamless asset reporting and documentation gathering. As filings involve multiple entities, investment accounts and even personal assets, having an all-encompassing view avoids duplication and lost opportunities. Q4 reporting preparation, in particular, exemplifies this skillset.

Household management also plays a role. Coordinating payments, payroll and household staff expenses require the same level of precision and timing as more formal financial documentation. Whether it is collecting receipts for property maintenance or reporting staff wages, attention to these details supports clean, timely filings.

Tailored Personal CFO Support

The personal CFO model gives one-on-one advice to individuals and families with wider obligations. This approach interfaces between family office admin, accounting and tax professionals. The personal CFO helps translate reporting requirements into actionable tasks. By managing deadlines, facilitating CPA coordination and reviewing the entire year’s transactions, this role underpins successful Q1 tax filing logistics. This extends to last-minute queries when Q4 data triggers unexpected questions from tax or legal teams.

Taking Control: How to Prepare for a Smooth Q1 Filing

Calendar Management and Internal Readiness

The earlier you prepare your calendar, the fewer risks of delay. Assign milestones for each element of the process—asset summaries, trust reviews, payroll collation—so that nothing runs late. Families with a proactive admin or household management expert enjoy less disruption and more confidence as tax deadlines loom.

Prepare checklists for each entity under your care, from trusts and estates to household payroll and business structuring. Each project lead—either the family office admin or designated accounting services lead—should run point on these lists. These small habits, repeated each year, reinforce strong habits that persist with changing regulations and personal circumstances.

Leveraging Technology and Digital Tools

Modern finance teams increasingly rely on cloud-based document storage, digital accounting platforms and secure communications. These systems streamline document collection and allow instant access for authorised professionals. For family office admin and personal CFO roles, adopting such systems saves countless hours compared to legacy record-keeping. Advanced platforms can serve as a single source of truth for all Q4 reporting data, trust accounts and business structure information. They also support rapid tax prep support by automating reminders and checklist completion.

Coordinating Across Teams: Advisors, Accountants and Legal Representatives

Harnessing Interdisciplinary Communication

Families, business owners and trusts benefit from regular communication between their in-house teams and outside service providers. Family office admin should initiate routine meetings with accountants, attorneys and investment advisors. These touchpoints decrease the chance of misstatement and uncover opportunities for tax strategy execution just before the Q1 deadline. Regular coordination also means that documentation is always ready if regulatory or reporting questions emerge during audits.

Collaborative planning began with Q4 reporting and continues as the year closes out. Updates from legal teams, changes from investment managers and new obligations for business structuring are all captured in one workflow. This approach supports rapid-fire responses to last-minute queries, ensuring timely tax filing every Q1.

Family Office Admin and the Final Review Process

Confirming Accuracy Before Submission

Checks and balances lead to higher accuracy when it is time to file. The final review, managed by family office admin or a personal CFO, cheques data integrity between all systems—accounting records, legal filings and trust documentation. Relying on this double-checking, with input from CPA coordination, prevents embarrassing and time-consuming errors after filing. Any last-minute additions or corrections are rapidly processed, decreasing the chances of amendments or notices from tax authorities.

A last review allows the team to consider if any strategic improvements—such as final contributions to trusts or adjustments to business structuring—should occur. Every document, form and summary must align perfectly to avoid holding up your tax filing logistics.

Emphasising the Role of Professional Partnerships

Engagement Models for Seamless Filing

Partnerships with skilled accountants, business structuring advisors and legal professionals pay ongoing dividends. When all parties communicate effectively, personal CFOs, household managers and family office admin function as one coordinated support group. This setup makes tax prep support a built-in feature of everyday financial management rather than a panic-driven event. Trusts and estates, asset summaries and Q4 reporting become routine checkpoints, not stumbling blocks.

As regulations change, these relationships allow for rapid adaptation. Families continue to feel confident that their tax strategy execution will remain compliant and efficient. Coordinated partnerships ensure support for each aspect of Q1 filings, consolidating expert guidance in a way that benefits every participant.