Preparing for tax filing in the first quarter presents a significant challenge for many individuals and families, especially those with complex

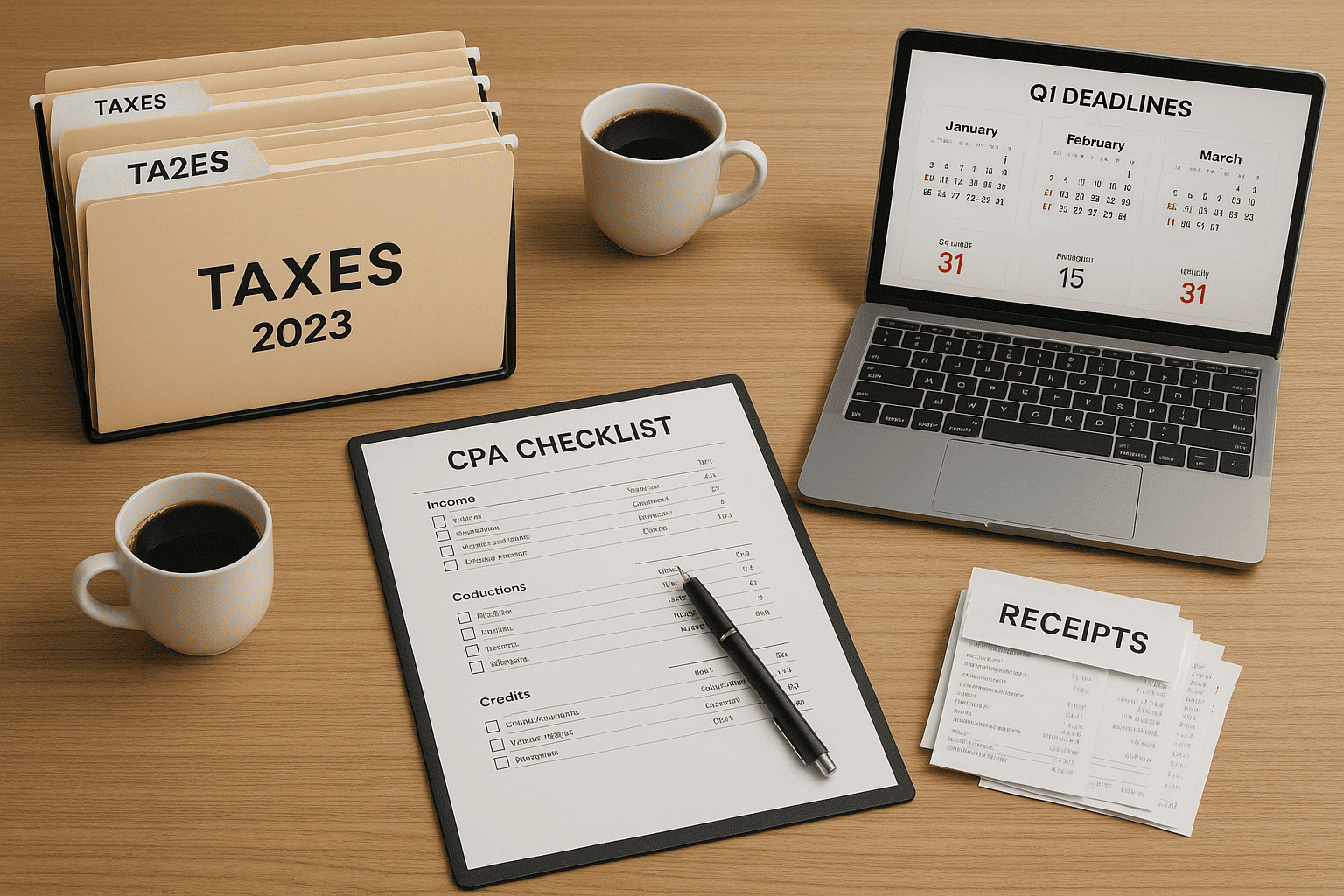

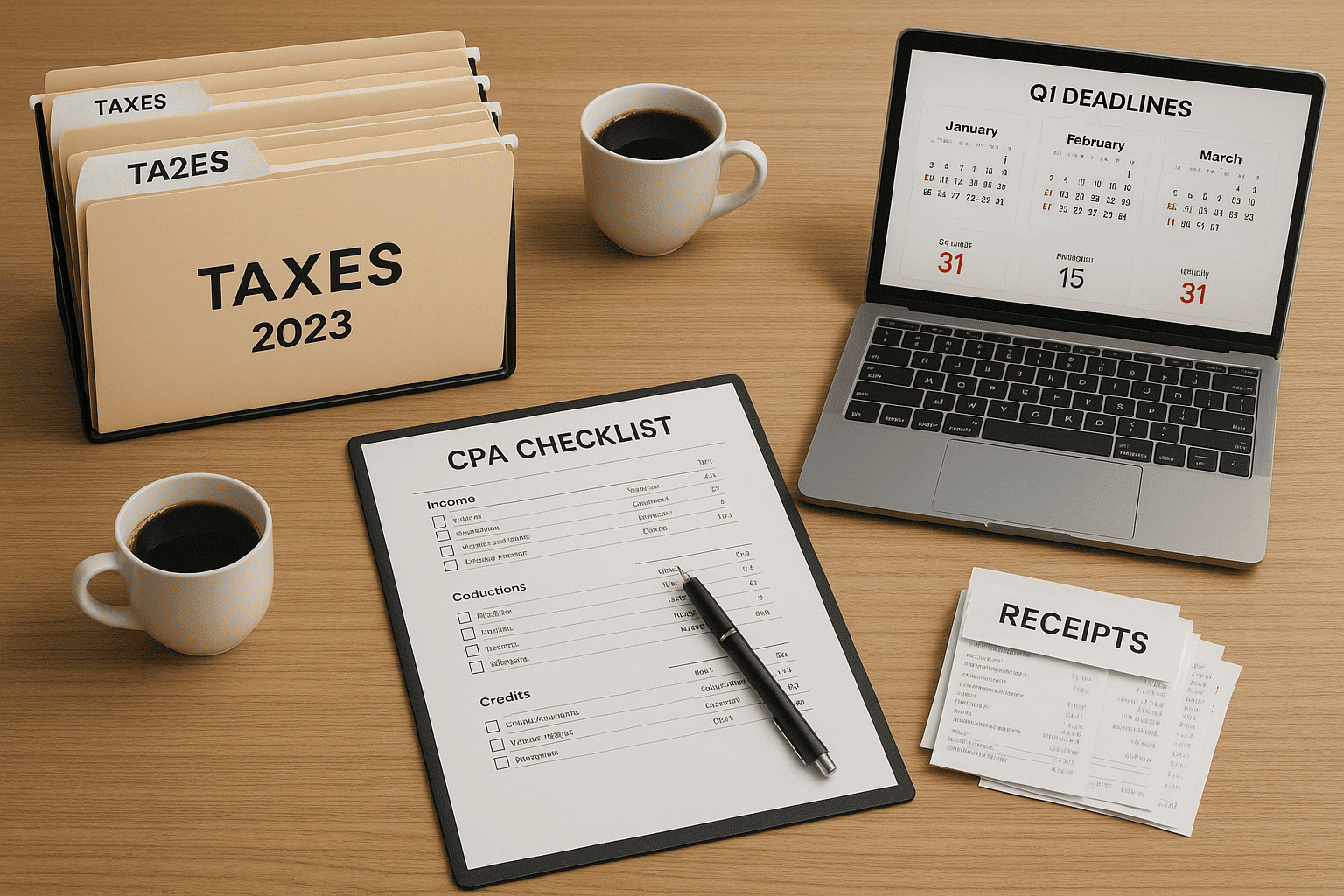

What You Need for Seamless Tax Prep Support and Filing in Q1

Preparing for tax filing in the first quarter presents a significant challenge for many individuals and families, especially those with complex

Managing personal estates extends far beyond writing a will. Many individuals overlook essential paperwork and legal steps, causing unnecessary

When the legal dust settles after a divorce and the final signatures are in place, the transition into a new chapter begins. For many individuals,

The Unique Demands of Bill Pay Services for HNWIs

High net worth families face a range of challenges when managing finances that differ

Trusts are an essential part of modern wealth management for high net worth families. These legal arrangements offer protection for assets,

Financial stability is vital for individuals and families to weather unexpected events. Whether it’s a sudden job loss, a health emergency, or fluctuations in the market, having a solid financial plan can make a significant difference. This blog will explore various strategies to prepare for financial uncertainties, focusing on maintaining liquidity, creating emergency funds, ensuring

The Importance of Household Financial Management Household financial management goes beyond merely keeping track of monthly bills. It’s a strategic element that should be integrated into a broader wealth strategy. By managing household finances efficiently, individuals and families can achieve long-term financial success. This involves not just dealing with day-to-day expenses but also includes cash

Owning luxury assets such as yachts, private jets, or rare collectibles can be both a symbol of status and a valuable investment. However, the financial responsibilities and considerations involved in luxury asset ownership extend far beyond the initial purchase. These assets require ongoing maintenance, insurance, taxes, and appropriate asset management to preserve their value over

The Overlooked Risk in Rapid Business Growth Business growth is a thrilling prospect for any entrepreneur. However, it’s essential to balance that excitement with a cautious approach, focusing on the potential pitfalls that can accompany rapid expansion. The rapid pace of growth can often overshadow the critical aspects of financial stability, cash flow management, and

Professional athletes experience unique financial challenges and opportunities throughout their careers. Unlike many professions that offer stable, long-term income, athletes often have short earning windows. This situation necessitates astute financial management for athletes and careful wealth preservation to ensure long-lasting financial security. The Importance of Financial Management for Athletes Athletes can earn significant sums of