As the final quarter of the year approaches, professionals must begin to focus on preparing financial operations for Q1 planning. Establishing a

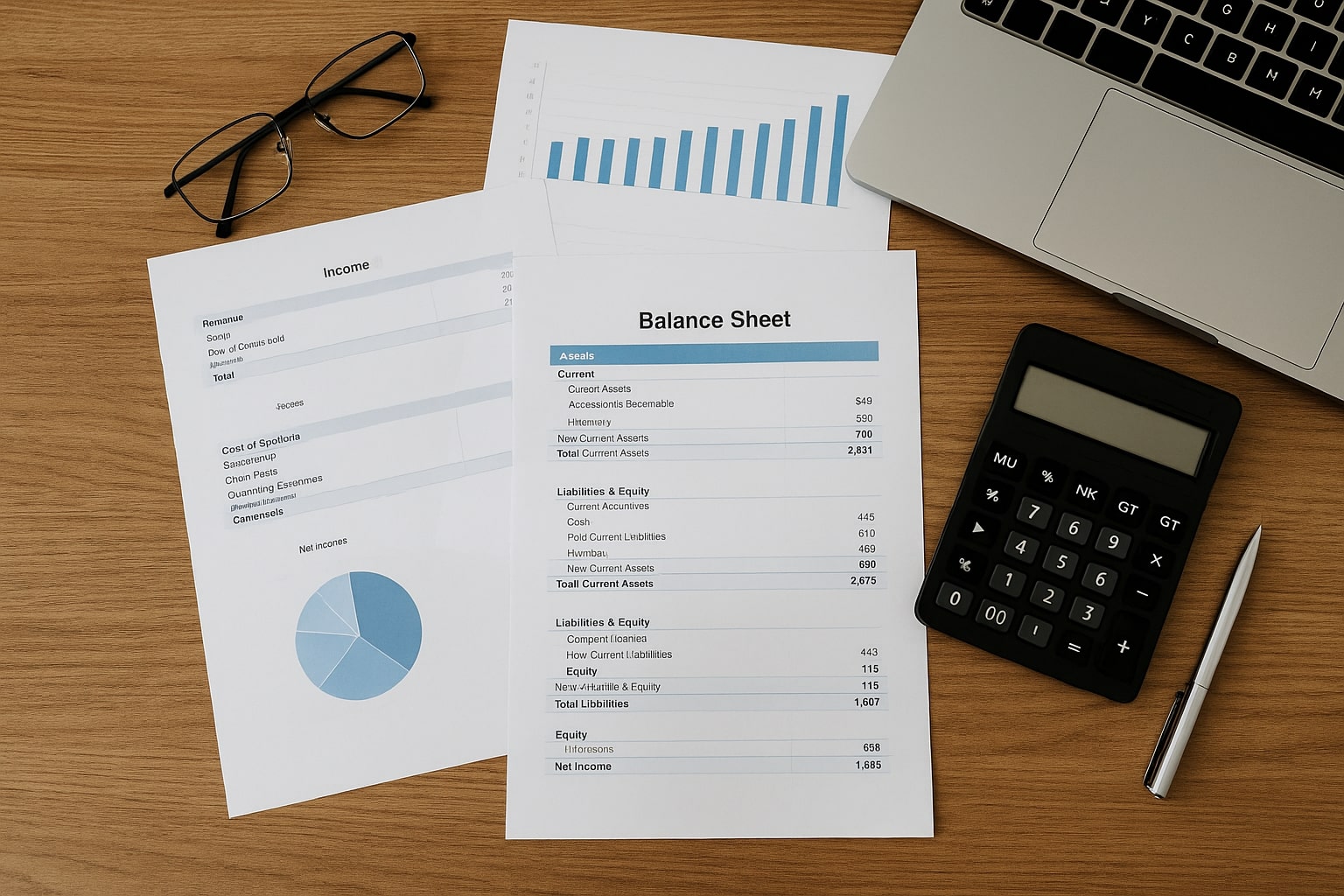

Preparing Financial Operations for Q1: What to Set Up Before the Year Ends

As the final quarter of the year approaches, professionals must begin to focus on preparing financial operations for Q1 planning. Establishing a

Managing a complex business or personal financial structure with multiple entities demands specialized knowledge and coordinated execution. Many

Keeping finances organized before January 1 proves valuable. As 2026 approaches, financial hygiene practices can make a significant difference in

Passing wealth and responsibility to the next generation can pose challenges for any family or business. The process becomes especially complex

As December approaches, family businesses start preparing for their end-of-year review. Staying on top of financial reporting ensures that

Political instability remains a considerable concern for investment professionals as they assess the risks connected with asset allocation,

As December 31 approaches, high-net-worth families and professionals overseeing multi-generational wealth face a critical window for year-end

Starting a new year with purpose is essential for every family

As the end of the year approaches, thoughtful planning for gifts can bring significant advantages to both individuals and families. Proper

Planning for private foundations often intensifies as the final months approach. For entities dedicated to structured giving, taking action